While air travel edges closer to its pre-pandemic heights in many parts the world, the aviation industry is far from returning to the same old routine. Our latest analysis reveals not only a diverse recovery pace among airlines, but also a substantial uptick in operational costs. Understanding the implications of these shifts and their impact on airports’ business strategies becomes essential.

In a landscape where precise route costs remain closely guarded secrets, we turned to the widely accepted Cost per Available Seat Kilometer (CASK) – a metric derived from airlines’ financial reports. It is calculated by taking an airline’s operating expenses and dividing it by the total number of available seat kilometers produced.

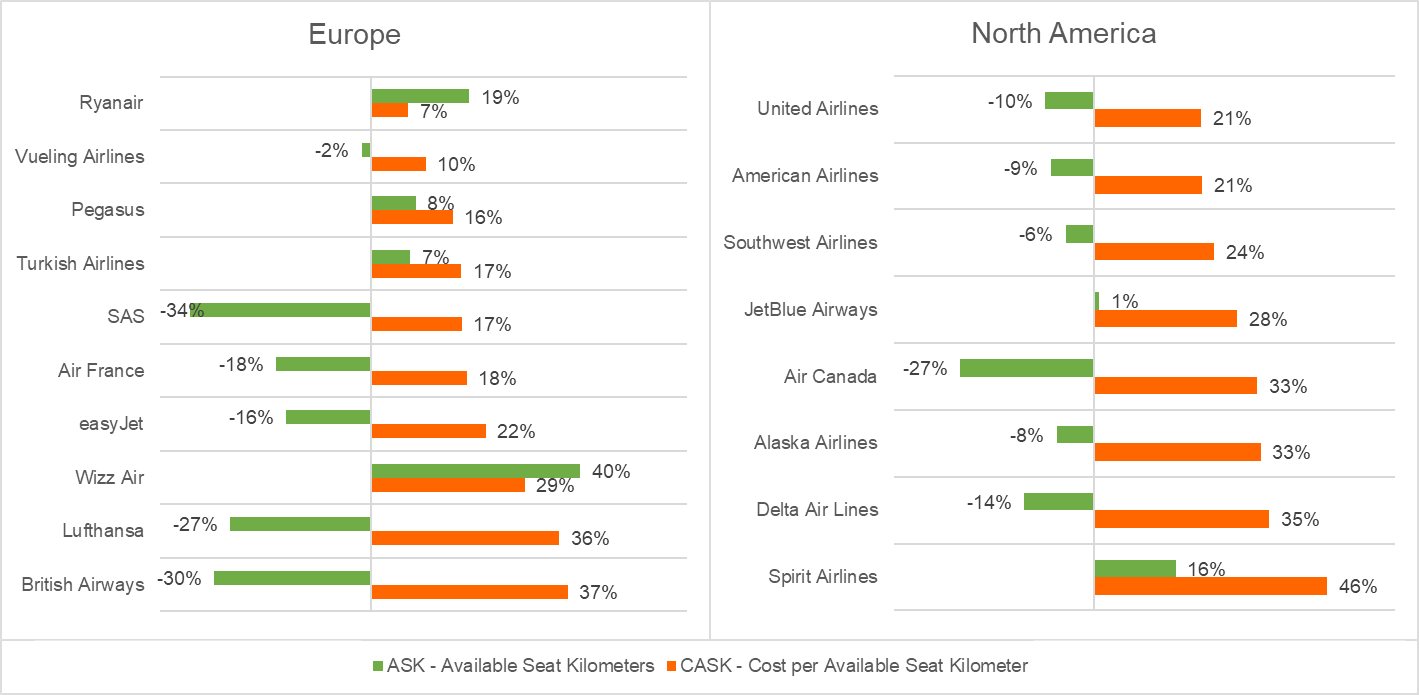

For this analysis, we set the focus on the cost dynamics in Europe and North America. Leveraging data from BEONTRA’s Route Forecasting solution, our exploration delved into the relative changes in CASK between 2019 and 2022. The following graphs illustrate a marked surge in operating costs across all airlines examined, ranging from 7% to 37% in Europe and 21% to 46% in North America. The average escalation stood at 21% in Europe and a striking 30% in North America.

Interestingly, European giants like Lufthansa and British Airways faced significant increases of 36% and 37% respectively in operating costs. Notably, their capacity measured in Available Seat Kilometers (ASK) was 27% and 30% lower in 2022 compared to 2019. However, the lag in recovery compared to other airlines cannot solely explain the cost spike.

Airlines with impressive capacity growth exceeding pre-pandemic levels, like Wizz Air in Europe and Spirit Airlines in North America, also faced excessively higher operating costs compared to the 2019 level. Given their ultra-low-cost carrier status, it’s reasonable to infer that soaring fuel prices played a significant role. The staggering 80% surge in jet fuel costs between 2019 and 2022 likely played a substantial part in this cost escalation.

Further details on the reasons behind the changes are beyond the scope of this article. But our analysis illuminates that the post-pandemic operating cost landscape has fundamentally shifted. With operating costs increasing by around 21% in Europe and 30% in North America, business development teams at airports should not only focus on the recovery of market volume, but also closely monitor the balance of load factors, fares and operating costs of their airline customers’ route networks – now more than ever.