Qantas has announced that it will introduce flights from Perth Airport (PER) to Paris Charles de Gaulles (CDG) just in time for the Olympic Games next year. The oneworld Alliance member is going to inaugurate the service on 12 July 2024 and will operate it with a 4/7 frequency during the Olympics and peak tourist season in Europe. From mid-August the frequency will be reduced to three flights per week.

This adds another destination to Qantas’ existing European network, that currently comprises London Heathrow (LHR) and Rome Fiumicino (FCO). Since the PER-CDG service will continue after the Olympic Games, the decision in favor of Paris must be a strategic one. Naturally, we’re curious which additional factors, apart from the USP “Olympic Games”, have led to the decision in favor of Paris and against other European hubs such as Frankfurt Airport (FRA), Zurich Airport (ZRH) or Amsterdam Airport Schiphol (AMS), which are all still missing in the Qantas network.

Status Quo & pre-COVID comparison:

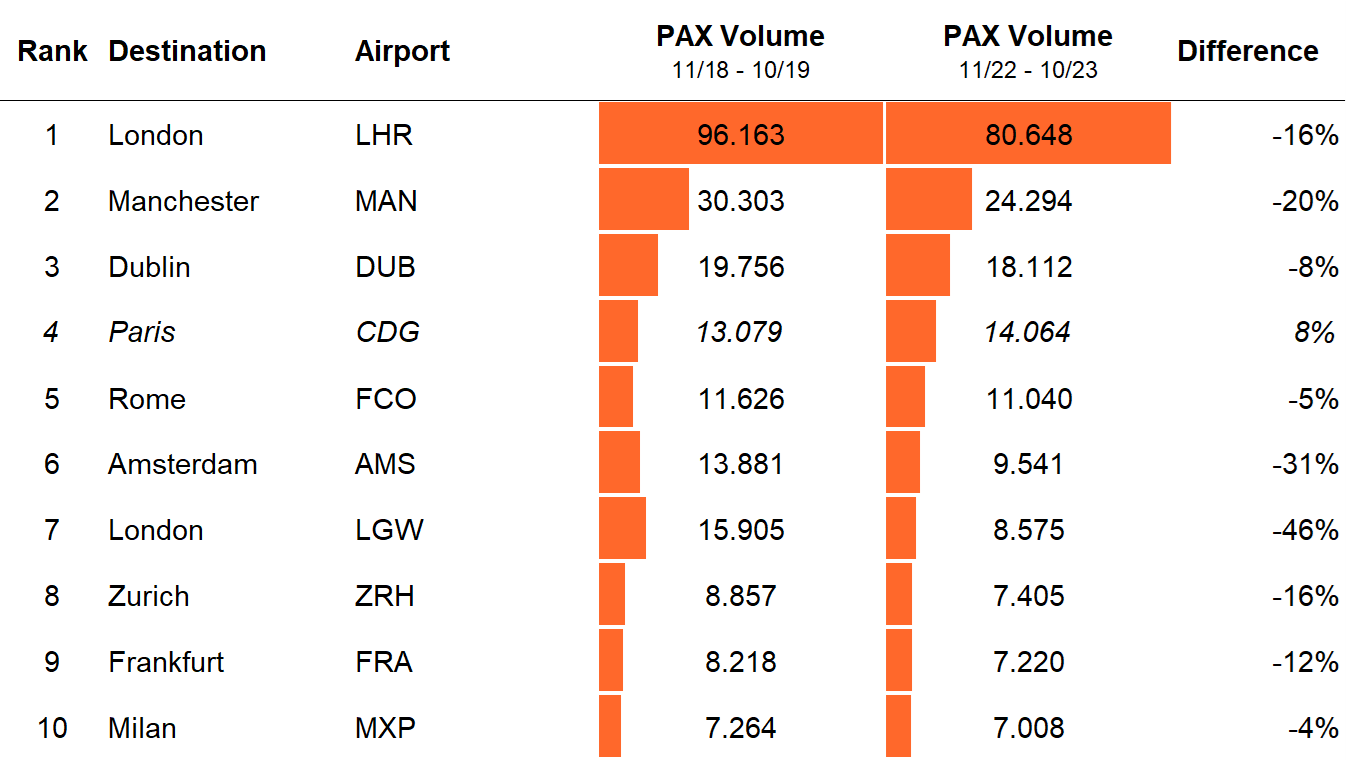

The table shows the Top 10 passenger potential (based on Sabre GDD, one-way) from PER to Europe in the period 11/22-10/23. Applying the elimination method, the decision in favor of CDG is obvious: apart from LHR, which is already served, only Manchester Airport (MAN) and Dublin Airport (DUB) have a larger potential than CDG. However, both are already perfectly connected via LHR, especially since British Airways, a Oneworld alliance partner, operates out of LHR. The remaining competitors are clearly falling behind CDG.

Hubs of other Oneworld carriers (Madrid, Helsinki) do not appear in the top 10. In addition, the transfer share (beyond traffic) is negligible at 7%, even in the case of LHR as a Oneworld hub.

The table above also shows that, when comparing our top 10 in terms of current and pre-COVID levels, only CDG has already returned to pre-COVID demand, which indicates increased popularity. In contrast, some of CDG’s competitors still lag significantly behind pre-COVID levels; for instance, AMS has only achieved two-thirds of its pre-COVID demand so far.

Consideration of behind traffic & pre-COVID comparison

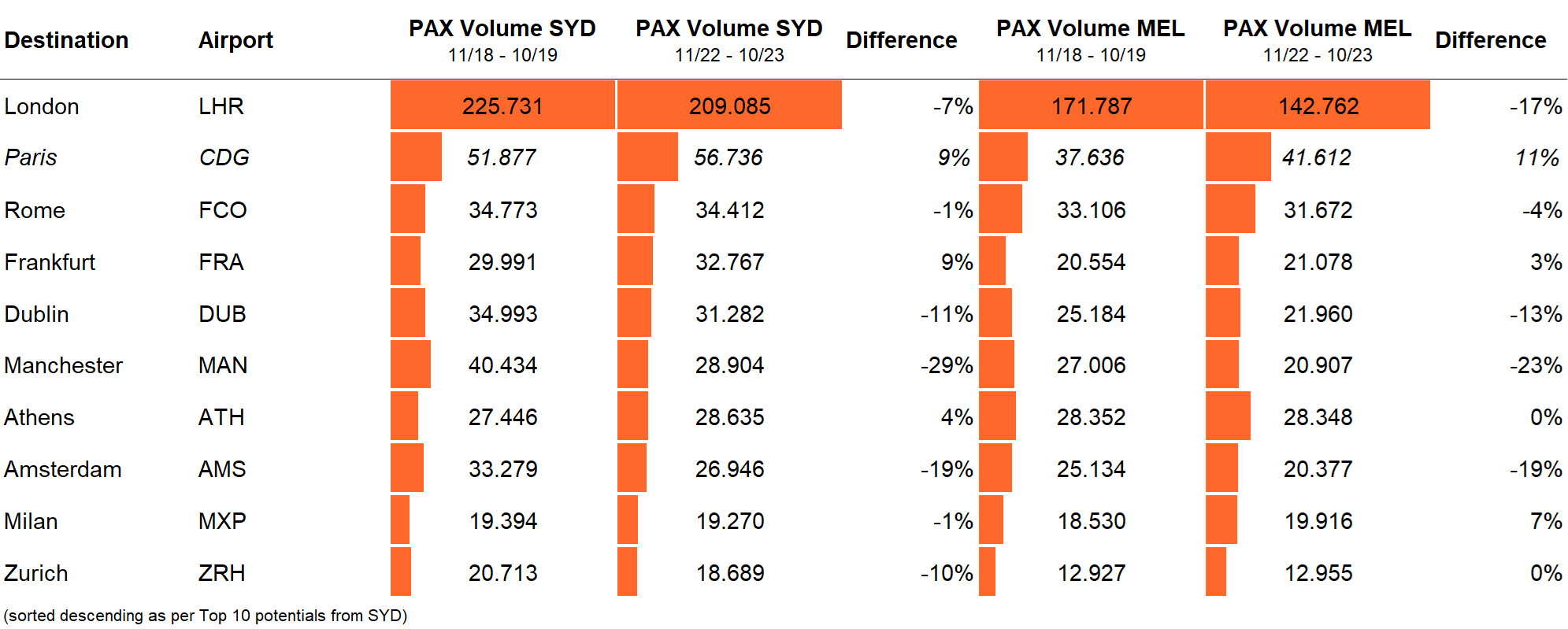

As mentioned earlier, beyond traffic only plays a minor role, at least for Qantas’ existing European connections. A different picture, however, appears when looking at the behind traffic (i.e. feeder traffic): in the passenger mix of PER-LHR the behind traffic makes up 58% of the total traffic, in the passenger mix of PER-FCO even 73%. When examining the O&D potential of Australia’s two busiest airports, namely Sydney Airport (SYD) and Melbourne Airport (MEL) (both potential behind airports of PER in terms of flight progression), a distinct overview emerges, as illustrated in the table below:

Apart from LHR, CDG has by far the largest O&D potential. If we again compare the current potential with the pre-COVID potential, CDG shows a recovery that is at least as strong as that of its competitors.

The analysis shows that the Olympic Games are not the only argument in favor of starting a connection from PER to Paris. Growing their European footprint, Qantas has undoubtedly made the right choice by favoring Paris over other destinations.