Since the announcement of Riyadh Air on 12 March 2023, the new airline is a hot topic within the travel and aviation industry. The airline will be operating from Riyadh Airport as its hub and aims to serve over 100 destinations around the world by 2030. This announcement prompted us to have a closer look at the already competitive situation in the Middle East and to draw up a comparison between some of the big players in the region.

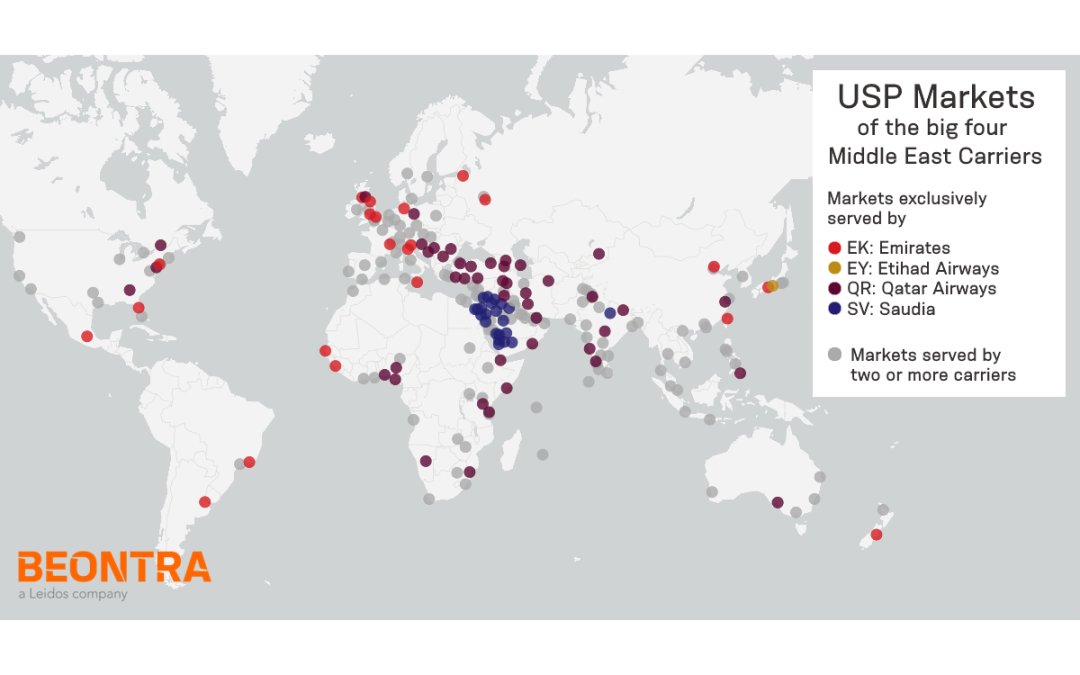

The map at the top visualizes the destinations of the flight schedule for June 2023 and highlights destinations served exclusively by one carrier. This makes it easier to identify the strategies the individual airlines pursue.

When studying the map it becomes obvious that Etihad and Saudia seem to be positioned more in the conservative camp, serving the major hubs and regionally dominant airports. With Nagoya (NGO), Etihad claim exclusivity to only one destination. This statement also applies to Saudi Airlines, which have only one exclusive international destination in their portfolio, Lucknow (LKO) in India. This aside, Saudi Airlines focus on their domestic market, and partly on the markets in the neighboring countries (i.e., Sharm el-Sheikh (SSH) in Egypt).

Considering the markets exclusively served by Qatar Airways, the network shows a strong focus on destinations in Southeast Europe, Turkey, the Caucasus, India and Africa. Secondary airports, such as Sarajevo Airport (SJJ), Belgrade Airport (BEG) or Sofia Airport (SOF) are also served, which strongly contributes to that regional densification. These are markets to which Emirates apparently do not claim any market share (which, however, could also be at least partly due to Emirate’s fleet comprising widebodies only). The markets that Emirates serve exclusively are exactly outside the “Qatar Airways corridor”. Not surprisingly, Emirates focus on the bigger airports in the respective countries and regions (i.e., Mexico City (MEX) in Central America, Buenos Aires (EZE) and Rio de Janeiro (GIG) in South America).

With four major airlines, the Middle East including Saudi Arabia is already perfectly connected to the world. Not only are the major hubs served, but also niche markets. Riyadh Air’s mission is to “provide tourists from around the world the opportunity to visit Saudia Arabia’s cultural and natural attractions” – we are curious to see which strategy will be adopted to achieve this goal.