As the global aviation industry evolves, airlines are constantly seeking new opportunities to expand their networks and meet the growing demand. In our previous article Sleeping Giants: Untapped Aviation Markets with the Potential for a Reawakening, we analyzed the top 10 untapped aviation markets worldwide. This time, we will take a closer look at the Asian aviation market, specifically focusing on routes in Asia that have not yet been considered for direct services by airlines, despite having proven to attract a considerable number of passengers before the COVID-19 pandemic started in 2019.

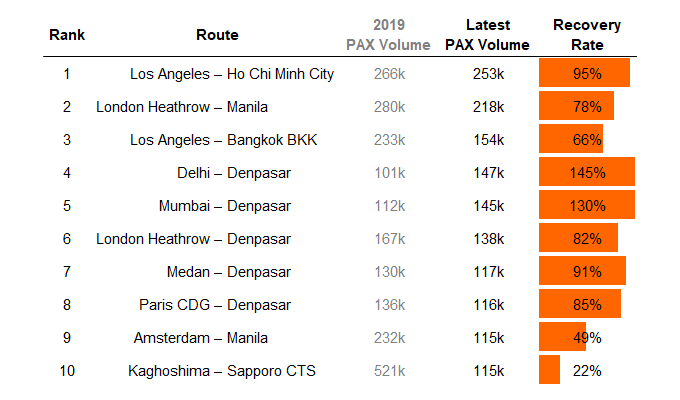

Using origin-destination demand data from the BEONTRA Route Forecasting solution, we have compiled a table summarizing the top 10 untapped Asian aviation markets based on passenger volume in the past 12 months (June 2022 – May 2023).

In the following, we will focus on summarizing the notable trends we identified:

Los Angeles to Ho Chi Minh City leading the ranking: The route from Los Angeles (LAX) to Ho Chi Minh City (SGN) stands out as the top contender in our ranking, with 253,000 passengers (bi-directional) in the past 12 months. This represents a remarkable recovery rate of 95% compared to 2019 levels. While this route holds tremendous potential for a launch of a direct service, serving it poses unique challenges due to its substantial flight distance of approximately 13,200 km. If introduced, it would easily become one of the longest flight routes operated by airlines worldwide. Thus, it remains to be seen which airline will take up this challenge and tap into this promising market.

Huge potential for direct services to Bali, Indonesia: One striking observation from the ranking is the presence of Denpasar (DPS) in Bali in Indonesia, appearing five times. This indicates the significant untapped potential for introducing direct services to this popular destination. There is potential for direct flights from the Indian market, with major airports like New Delhi (DEL) and Mumbai (BOM), as well as from Europe, with London and Paris being the largest metropolitan regions and their respective hubs, Heathrow (LHR) and Paris Charles de Gaulle (CDG). Furthermore, there is also potential for a domestic direct service from Medan (KNO). It’s worth noting that the recovery rates for routes from New Delhi (DEL) and Mumbai (BOM) to Denpasar (DPS) have already surpassed 2019 levels, with recovery rates of 145% and 130% respectively.

Lagging domestic routes in Asia: Upon closer examination of the current recovery rates for the top 10 untapped Asian routes, it becomes apparent that domestic routes in Japan, but also Indonesia and China, are lagging behind. Their recovery rates are still way below 50%, whereas all international routes in the ranking have already recovered at least by 50%.

An example of this is the domestic route from Kagoshima (KOJ) to Sapporo (CTS) in Japan, which has a current recovery rate of 22%. This highlights the fact that full connectivity has not yet returned to pre-COVID levels, especially for some of the domestic city pairs in Japan. While airlines are trying to restore their capacity and network, there are also domestic routes in other Asian countries such as in Indonesia or China, with the domestic route from Guiyang (KWE) to Shenyang (SHE) as one concrete example, even not appearing within the above ranking. This indicates that demand for some routes within China remains low, despite IATA projecting that domestic air travel in China will likely recover to its 2019 monthly level by summer 2023.

While the demand for international routes in Asia is already showing positive signs with promising markets for new direct flights, there is still catching up to do for domestic routes in several Asian countries in terms of passenger demand and volume compared to 2019 levels. It will be interesting to observe to what extend the potential of the untapped Asian routes will be unleashed in the coming weeks and months.